February 2026 has had that weird market vibe where some parts look fine, even cheerful, while tech names suddenly feel heavy. One day the indexes are calm, the next your watchlist is a sea of red.

This is the part many people miss: a product update can move stocks because investors don’t price a company on what it did last year. They price it on what it can sell next year. If a new AI tool starts doing the same work that software firms and IT service providers bill for, markets revalue those businesses fast, sometimes in hours.

That’s what happened as Anthrophic's New Claude Tools started getting talked about like more than a chatbot upgrade. The story wasn’t “Claude writes better text.” It was “Claude can finish multi-step work, inside the apps teams already use,” which is a very different threat.

Claude positioned as a hub for real workplace tools, not just a chat window, created with AI.

Claude positioned as a hub for real workplace tools, not just a chat window, created with AI.

What Anthropic actually launched, and why it feels different this time

The simplest timeline is late January to early February 2026, and the theme is consistent: Claude is being pushed from “answer machine” to “work finisher.”

On January 26, 2026, Anthropic rolled out Claude Apps, a directory of connections that let Claude operate closer to where work already lives. Soon after, the company introduced Claude Cowork, which is presented as an agent-style worker that can plan and execute tasks across steps, not just respond to one prompt.

Then on February 3, 2026, the legal-focused plugin landed, and that’s when a lot of investors seemed to sit up. Legal review, compliance checks, risk flags, report drafts, these are not novelty tasks. These are paid workflows.

One technical piece matters, but we can keep it simple. Anthropic’s connector approach is built on Model Context Protocol (MCP), an open standard it introduced earlier (2024). In plain English, MCP is a safer, structured way for the model to pull context from tools and send actions back.

If you want a broader grounding in why agents are suddenly the story, this older internal piece still holds up: AI agents in 2026 will look more independent.

Claude Apps: letting Claude work inside tools teams already use

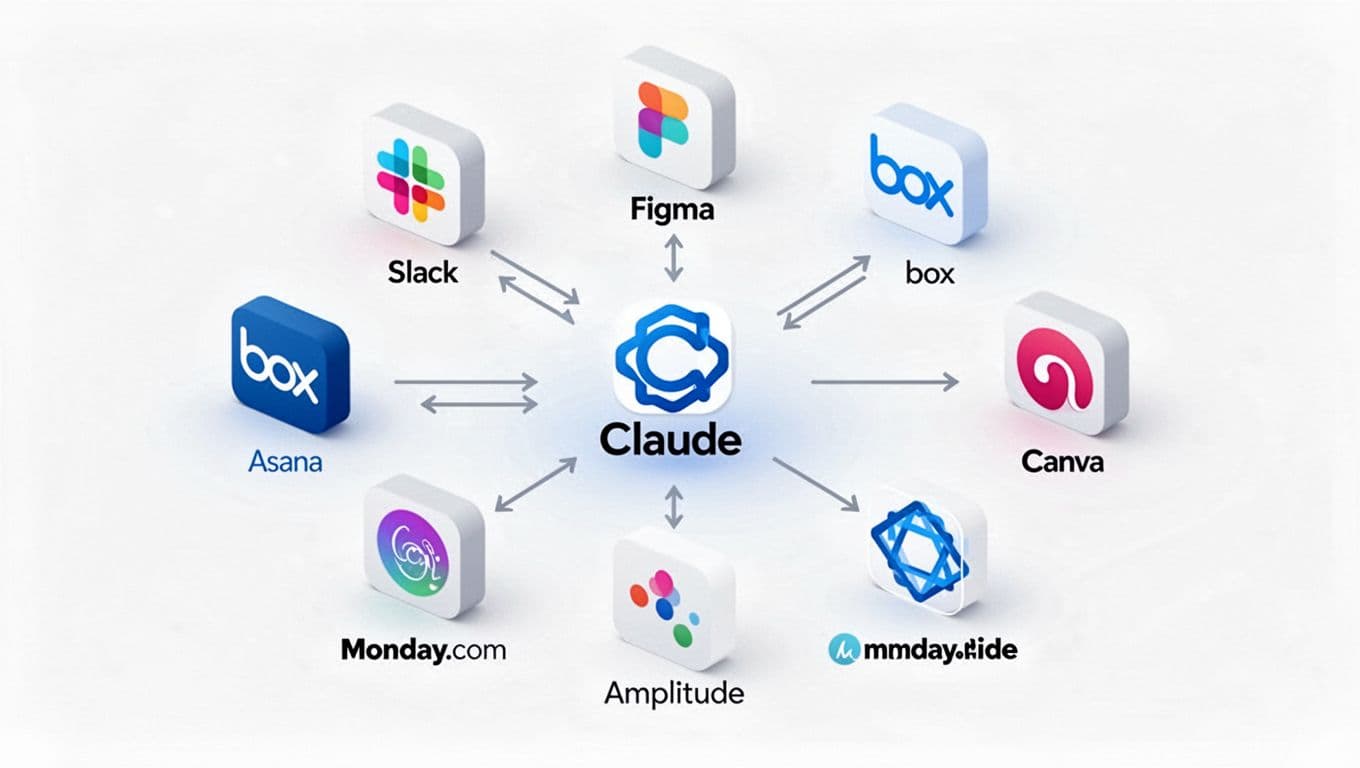

Claude Apps are best understood as interactive mini workflows that sit “in” Claude, but reach out to your actual software. Reports in early February listed connectors like Slack, Figma, Asana, Canva, Box, Monday.com, Amplitude, and Hex, with more promised.

What does that mean for a normal person at work?

It means you can ask Claude to pull a file from Box, summarize it, draft a Slack update, create a task in Asana, and generate a simple chart from a dataset without bouncing between five tabs. That tab-hopping is where a lot of office time disappears, quietly.

Availability matters too. Claude Apps were positioned as a paid-tier feature, focused on web and desktop use (Pro, Max, Team, Enterprise). Also, some obvious suites were not in the list yet, like Microsoft 365 and Google Workspace, which tells you this is early, not “done.”

Claude Cowork and plugins: the big leap from answers to completed workflows

Cowork is where the mood changes. It’s framed as “no-code” in spirit: you describe a goal, the agent breaks it into steps, does the steps, checks its own work, and keeps going with minimal supervision.

The early February plugin news made the threat feel more direct. The legal plugin was described as handling document review, NDA screening, risk flagging, compliance checks, and producing a report from all that. That’s the kind of work people pay for because it’s tedious and high-stakes at the same time.

And markets know this won’t stay isolated. OpenAI and Google are building agent-style systems too, with deep pockets and distribution. Investors don’t need every detail, they just need to believe the category is about to spread.

For a quick explanation of how this became a “SaaSpocalypse” headline, see this overview from News18’s breakdown of the SaaSpocalypse narrative.

Why these Claude tools sparked a rout in IT and software stocks

Stock sell-offs are rarely about one thing, but the cause and effect here was unusually clean. When AI starts eating into billable work and subscription “moats,” investors don’t wait for quarterly earnings to confirm it. They reprice on fear first, then negotiate back toward reality later.

Market coverage around February 3 to 4 repeatedly cited around $285 billion wiped from software and adjacent names in a sharp move, tied to the idea that agent tools can replace chunks of what software seats and service hours used to do. Some reports also pointed to steep drops in legal and information services firms, the type of businesses that monetize documents, research, and compliance.

This didn’t stay local. In India, IT stocks were hit even as other parts of the market were stronger. Reports described a sharp fall in the Nifty IT index (over 6% in one session), and headlines talked about large amounts of investor wealth erased in a very short window. Globally, US software baskets also slid hard, with market commentary comparing it to prior mini panics in the sector.

Photo by Déji Fadahunsi

Photo by Déji Fadahunsi

If you want one representative summary of the sell-off framing, this market write-up on TradingView about Claude plugins and the software selloff captures the investor logic pretty well.

The “SaaSpocalypse” fear: AI moves from a feature to the whole product

For years, SaaS companies have said, “We’ll add AI features.” That sounds safe. A nicer search box, a helpful assistant, a summary button.

Agents flip the shape of the product. If Claude can connect to your tools and complete the workflow, some single-purpose apps risk becoming optional. Not worthless, but optional, and optional products get their pricing power squeezed.

The deeper fear is about ownership of the workflow. Anthropic isn’t only selling model access anymore. With apps, agents, and plugins, it can start to sit in the middle, watching tasks flow through, learning which steps matter, and capturing value at the orchestration layer.

That’s also why legal, publishing, and info-services names showed up in the same conversation. These are industries where “finding and interpreting documents” is the product. If the AI can do that faster, the market starts asking uncomfortable questions.

A mainstream recap of this angle is in CNBC TV18’s explainer on the Claude tool and SaaSpocalypse talk.

Why India’s IT model feels exposed when entry-level work gets automated

India’s IT industry was built on a simple engine: deliver a lot of output at a lower cost, across coding, testing, process work, and compliance-heavy support. By most estimates, the sector is around $280 billion in scale.

Agent tools don’t replace every engineer, and they don’t magically run big transformations alone. But they can reduce the amount of junior work needed per project. That’s the pressure point.

In recent layoff cycles, reports said global IT firms cut 100,000-plus jobs, and roughly one-fifth of those cuts hit workers based in India. What stung was that it wasn’t only coders. Support roles, HR ops, and compliance staff also got squeezed because automation now reaches into those routines too.

Cowork-style agents sit right on top of that kind of work: write code, test it, fix bugs, check documents, produce a report, crunch data, and keep moving. Humans still supervise and handle edge cases, but the volume of “someone has to do this manually” work shrinks.

That forces a shift. Indian IT firms can still win, but the path looks more like higher-end engineering, AI governance, security, and domain solutions than pure scale delivery.

For a related internal take on why “agents that ship” matter (not just agents that talk), this piece on Deep Agent’s autonomous web service builder fits the same pattern, different product.

A simple visual of the kind of one-day drop that rattles confidence, created with AI.

A simple visual of the kind of one-day drop that rattles confidence, created with AI.

Who gets hurt, who benefits, and what to watch next

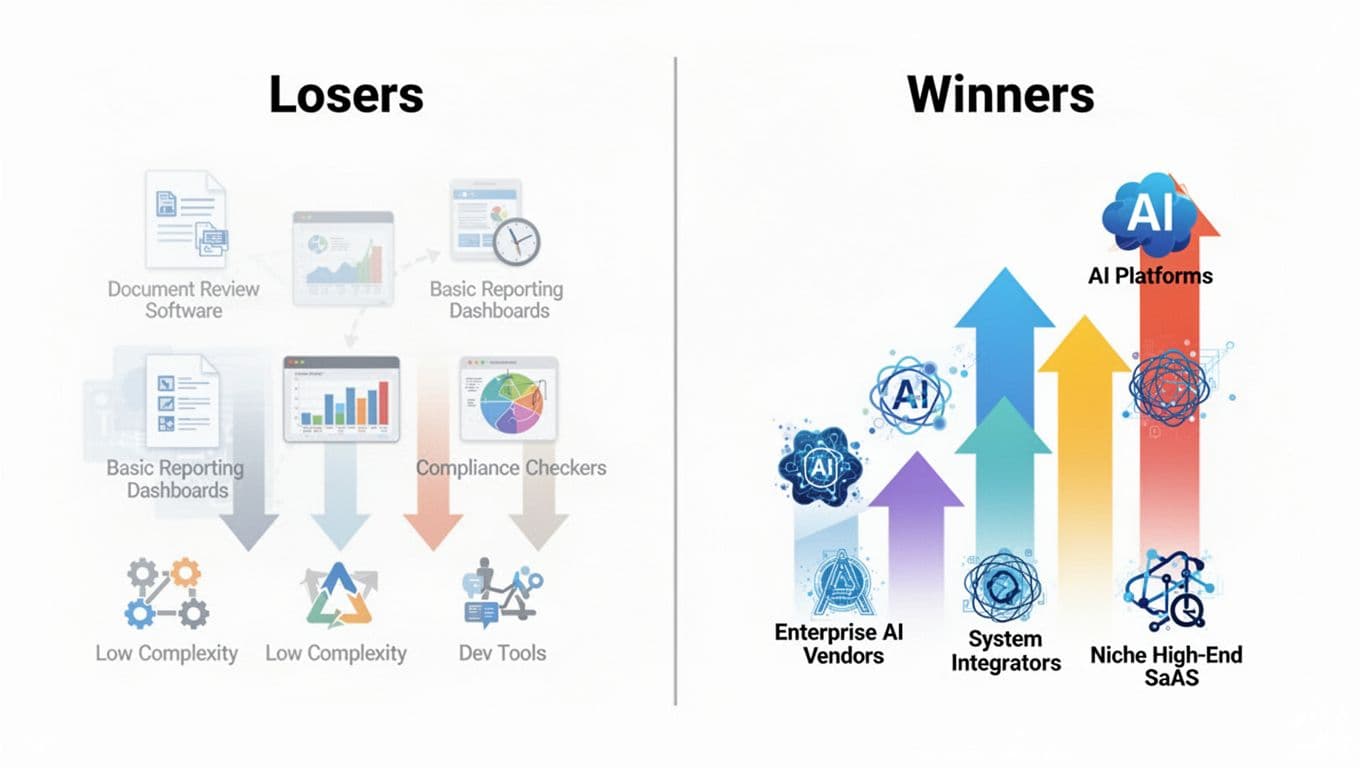

The sell-off felt emotional, but it wasn’t random. The pain clustered around businesses that look most like “paid steps,” where the value is the manual labor of moving information from one place to another, checking it, formatting it, routing it, and documenting it.

At the same time, some of these moves can fade. Markets sometimes overreact when a demo goes viral. A tool can look magical at first, then reality hits: messy data, permissions, security approvals, slow procurement, and plain old human resistance.

So it helps to watch a few real signals, not vibes. Are these tools in paid tiers people already use? Do they have integrations that reduce switching costs? Do they produce consistent outcomes across many runs? And do they stand up in regulated settings?

This is also where competition matters. If OpenAI and Google ship similar agent workflows, adoption could speed up fast. If they stumble on safety and reliability, it could slow down and give incumbents room to respond.

A simple way to think about where value may shift as agents take over routine steps, created with AI.

A simple way to think about where value may shift as agents take over routine steps, created with AI.

Likely losers: tools that sell “busywork” and charge for manual steps

The most exposed categories tend to be the ones that monetize routine handling, not deep expertise. Document review and compliance software that mostly routes templates, basic reporting tools that turn a dashboard into a PDF, low-complexity QA and test scripting, and rote HR ops are all in the splash zone.

The risk is not “they go to zero.” The risk is pricing and seat count. If an agent collapses a five-seat workflow into two seats plus an agent subscription, the math changes. It’s like buying a washing machine after years of paying someone to hand-wash. Some people still pay for hand-wash, but the market size drops.

Likely winners: firms that turn AI into reliable outcomes, not demos

The winners tend to look boring on the surface: strong domain products, proprietary data, audit trails, and integration muscle. Enterprises don’t just want an agent that can do things, they want one that can do things and explain what it did.

System integrators, security providers, and firms that build governance layers can gain here. So can niche SaaS players with deep, specialized workflows that aren’t easily replaced by a general agent.

For India’s IT giants, the opportunity is real if they move quickly: AI transformation programs, secure deployments, evaluation frameworks, industry copilots, and higher-end engineering that wraps agents into real business systems. The old model was “more people, more output.” The next model is “fewer steps, better outcomes.”

What I learned watching this sell-off up close (and how it changed how I read AI news)

I had one of those small moments that sticks. I was scrolling through social posts where people were stitching together mini apps, fast. Not “hello world” stuff, but little tools that actually do something, pull a file, generate a report, send an update. Then I flipped over to a market heatmap, and it was turning red in a way that felt… immediate. Like the market was watching the same clips.

That’s when it clicked for me: AI news matters most when it removes steps. Not when it adds a shiny feature. Removing steps is what hits revenue.

I also noticed how the conversation changed once plugins got specific. “AI is good at writing” is abstract. “AI can review NDAs and flag risks” is uncomfortably concrete. You can imagine the budget line item it threatens.

But I’m also trying to keep myself honest. Hype cycles are real, and I’ve been fooled before. Now I look for boring adoption signals: is it locked behind a paid tier (which usually means it’s meant for real work), are integrations stable, does it run the same workflow reliably ten times, and can compliance teams live with it. If those boxes get checked, then yeah, a sell-off starts to make more sense, even if the first move was too sharp.

Conclusion

Claude Apps, Cowork, and plugins push Claude from chat into action, and that’s what rattled software and IT stocks. When AI starts completing real workflows inside Slack, Figma, Box, and legal review pipelines, investors quickly question how durable old business models are.

The next few weeks will be about rollout speed and enterprise adoption, plus what competing agent systems from OpenAI and Google ship in response. And for IT service firms, the big watch is whether they climb toward higher-value work fast enough, before too much junior, repeatable work gets priced down.

0 Comments